Click Here to View The Newsletter in a PDF Document

A Message From Our COO, Renee Farida

Dear Valued Client,

As April unfolds with its promise of renewal and growth, we at Householder Group are inspired by the fresh perspectives this month brings. It’s a time to embrace new beginnings, not only in our surroundings but also in our financial endeavors. Our commitment to your financial well-being is unwavering, and we are here to support you in navigating the ever-changing financial landscape with confidence and clarity.

This month, we turn our focus to the importance of Flexibility and forward-thinking in our financial strategies. As we witness the world around us bloom, we are reminded of the potential for growth and transformation in our own lives. Our team is dedicated to ensuring that your financial plans are not only resilient but also proactive, anticipating the opportunities and challenges that lie ahead. In the spirit of tax season, here’s a fun fact: Did you know that the U.S. tax code is over 4 million words long, making it more complex than the entire Harry Potter series combined? As we navigate this intricate landscape, we’re here to assist you with your tax planning needs and ensure that your financial strategies are optimized for tax efficiency.

In this spirit of renewal, we encourage you to:

Embrace Change: Consider how recent developments in your life or the economic environment might impact your financial goals. Let’s work together to adjust your strategies accordingly.

Seize Opportunities: With the dynamic nature of the markets, now is an ideal time to explore new investment avenues that align with your risk tolerance and long-term objectives.

Plan for the Future: Reflect on your long-term vision and how your current financial decisions are shaping your path forward. We are here to guide you in making choices that pave the way for a prosperous future.

Exciting News: We are hosting a National Zoom Document Retention Webinar on April 30th. This is a fantastic opportunity to learn about best practices for managing and retaining important financial documents. Stay tuned for more details and registration information!

At Householder Group, we believe in building lasting relationships based on trust and personalized service. Our approach is tailored to meet your unique needs, ensuring that your financial plan is a true reflection of your aspirations. We are committed to guiding you with integrity and expertise, every step of the way.

Thank you for entrusting us with your financial journey. We are excited to embark on this journey of growth and success together in April and beyond.

Warm regards,

Renee Farida

COO

Party Like It's 1995

The year 1995 was an exciting one. Michael Jordan came back from retirement, digital video disks (DVDs) were invented, Netscape went public after introducing the world to the internet via its web browser, and Coolio’s “Gangsta’s Paradise” was the song of the year. It was also an exciting year for investors.

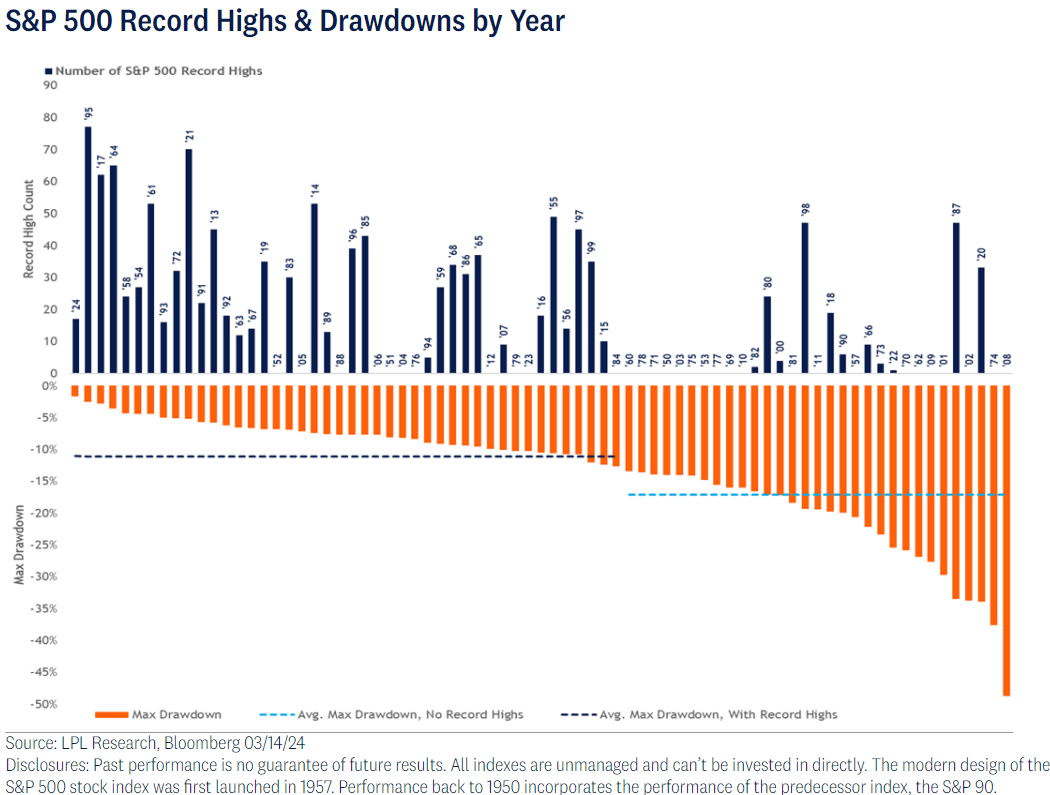

After stumbling into the start of the year from drastic Federal Reserve (Fed) rate hikes in 1994, the S&P 500 quickly regained its footing and rallied consistently higher throughout 1995, amassing 77 record-highs along the way and setting a record for the largest number of new highs in a calendar year. For context, this equates to the market generating a new high every 3.3 trading days, leaving little room for

downside volatility. During the year, the S&P 500 witnessed a maximum drawdown of only 2.5%, setting another record for the index.

Legendary technical analyst Ralph Acampora, who was running technical research at Prudential during the time, wrote a lengthy research note outlining his thesis for the Dow to reach 7,000 by early 1998, a bold call considering the index was trading only around 4,500 at the time. To the surprise of many, the Dow cleared the 8,000-point milestone by July 1997. And to the surprise of Ralph, the CEO of Prudential at the time gifted him a 1962 Corvette (part of Ralph’s thesis was predicated on market similarities from the 1962–1966 bull market). Another catalyst for his bullish forecast stemmed from the degree of skepticism following what many considered a stealth bear market in 1994.

Fast forward to 2024, and Michael Jordan is more likely to be playing golf than basketball, DVDs are collecting dust if they have not already been thrown out (I am still holding onto my Seinfeld collection), and Coolio has unfortunately passed away. And while many things have changed over the last 30-plus years, there are still some close market parallels between the 1994-1995 era and today.

Stocks are continuing to print record highs aboard a bull market built upon fear and skepticism. The S&P 500 has notched 17 new highs this year already. For context, this equates to a new high occurring roughly every three trading days. If this pace were to continue, the S&P 500 would have around 86 record highs in 2024, rivaling the record number of 77 registered in 1995. Perhaps equally as impressive as the market’s rate of change is the lack of downside volatility this year. The S&P 500 has only witnessed a maximum drawdown of 1.7% this year, which if this somehow holds (unlikely in our opinion), would break the record of the lowest drawdown of 2.5% set in 1995.

Similarities in price action between two periods is one thing, but similarities in economic conditions and the macro environment are another, and when they all align, our confidence builds for price action to at least rhyme. In 1994-1995, the Fed doubled interest rates to 6% to combat elevated inflation and cool the economy. The bond market suffered sizable losses and stocks stumbled into the tail end of the rate-hiking cycle. However, there was no recession as inflation stabilized and the economic expansion continued. As a result, the Fed cut rates in the summer of 1995, adding fuel to the bull market.

Turning back to history, what kind of pullback should investors expect? Years with record highs tend to have less downside volatility than years without. Since 1950, the maximum drawdown for the S&P 500 during years with a record high averaged -11.0%, compared to the average drawdown of -17.1% during years without a new high. Furthermore, annual S&P 500 price returns during years with a record high have averaged 13.7%, suggesting this year’s rally could have more room to run. This compares to average returns of only 3.0% during years without a record high.

Summary

The S&P 500 continues to print new highs as earnings and economic growth point more toward a soft-landing scenario than a recession. While inflation data remains more volatile than the market desires, investors appear complacent with the notion of rate cuts being on the horizon, and less concerned over the exact timing. The current backdrop also has many similarities to 1995, a year with limited downside volatility and unprecedented momentum, providing an applicable history lesson to today’s market that overbought conditions can persist for meaningful periods.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

For Public Use – Tracking: #554253

Fear of Markets?

Key Takeaways

Fear of Missing Out and Fear of Losing it All can potentially limit long-term returns.

Market highs tend to cluster and lead to new highs and shouldn’t be feared as the start of the next downfall. Market corrections are part of a healthy market and provide an opportunity to invest at lower prices.

Diversification across a mix of different investment strategies is a way of dealing with the fear of knowing that something is working in today’s market while also providing a smoother ride towards long-term goals.

Fear, that unpleasant emotion caused by a belief that something is going to happen to cause pain, is ever present in the investment world. The key words here are ‘emotion’ and ‘belief,’ and they lead to ill-timed investment decisions.

As markets hit new highs, there’s fear of missing out (FOMO) on further upside potential. But on the flip side, there is also fear of losing it all (FOLIA) if markets are at a peak and could see a potential correction.

Market Highs

While many may believe that new market highs may mark the start of a new downturn, if we look back in history, the all-time market highs tend to cluster, and new highs are followed by more new highs. The momentum behind the new all-time highs tends to be self-feeding as that fear of missing out drives investors into the market. This allows the market to continue to rally and new highs to persist for longer periods than may be intuitive.

Going back to 1950, almost 7% of all trading days saw a new all-time high. And that percentage increases during market rallies. Looking at one of the strongest bull markets – the 1990s – over 12% of trading days saw new all-time highs. Post Grand Financial Crisis, 2013-2019 all-time highs were seen on 14% of trading days, and so far in this decade – the 2020s – 11% of trading days saw a new high despite going through 2 bear markets.

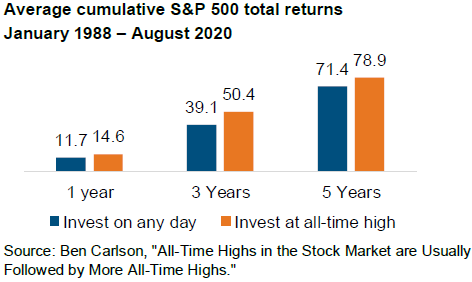

In fact, investing at all-time highs is not to be feared. As seen in the chart below, investing at an all-time high provided a higher relative return over multiple time periods than investing on any day.

Market Lows

We all fear the bear market and losing the nest egg that has grown over the years – we spend time and potential return fearing for the big market crash (fall of 50% or more) – an event that is actually fairly rare. There have only been five market crashes in the past 100 years.

Bear markets (loss of 20% or more) or corrections (loss of 10% or more) are more frequent, though. In fact, since 1928, there have been 55 falls of 10% or more, of which 33 are market correction and 22 are a bear market. On average, we see a bear market once every four years, with a fall of 36.6% over 381 days. While on average, we see a correction once every 18 months, with a fall of 13.8% over 116 days.

Market corrections are more common and actually a healthy part of a normally functioning market that responds and reacts to the changing economic environment. It’s the market’s way to take a pause, and it can be a time to invest, taking advantage of some lower prices.

Some may ask why a correction of -13.8% is considered healthy. Sometimes, the markets get ahead of themselves, and can lead to market exuberance and a potential unhealthy market crash. Think about corrections like taking your foot off the gas pedal – when you get too close to the car in front, you need to ease off to limit the potential of a crash.

Removing the Fear

Markets are living organisms that have a life of their own. They are hard to predict and hard to time, so what is an investor to do to remove the fear of missing out or the fear of losing it all?

Have a plan and stick to it! Prepare portfolios for different market environments before they occur by diversifying them across different investment strategies. Understand the role of investments in your portfolio and know that they are not all going to perform in the same way all the time. But over time, they should provide you with a smoother ride and take some of those emotions out of investment decisions, knowing something in the portfolio is working in the current market environment.

Important Information

This is for informational purposes only, is not a solicitation, and should not be considered investment, legal or tax advice. The information in this report has been drawn from sources believed to be reliable, but its accuracy is not guaranteed and is subject to change. Investors seeking more information should contact their financial advisor. Financial advisors may seek more information by contacting AssetMark at 800-664-5345.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss. Actual client results will vary based on investment selection, timing, market conditions, and tax situation. It is not possible to invest directly in an index. Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly. Index performance assumes the reinvestment of dividends.

Investments in equities, bonds, options, and other securities, whether held individually or through mutual funds and exchange-traded funds, can decline significantly in response to adverse market conditions, company-specific events, changes in exchange rates, and domestic, international, economic, and political developments. Bloomberg® and the referenced Bloomberg Index are service marks of Bloomberg Finance L.P.L. and its affiliates, (collectively, “Bloomberg”) and are used under license. Bloomberg does not approve or endorse this material, nor guarantees the accuracy or completeness of any information herein. Bloomberg and AssetMark, Inc. are

separate and unaffiliated companies.

AssetMark, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission.

©2024 AssetMark, Inc. All rights reserved.

C2 4 21011 | 0 3 /202 3 | EXP 0 3 /31/2025

2024 Document Retention National Webinar

Don’t Forget to RSVP to Our National Webinar This Month!

Join us on April 30, 2024, for our upcoming webinar, “Securing the Past: Strategies for Effective Document Retention,” with Jerry Blakely, the Householder Group’s Director of Training & Development. Come and discover key insights that may help you establish a robust document retention policy, overcome challenges in document management, and ensure the security and accessibility of essential information.

Don’t miss this chance to enhance your knowledge in safeguarding your important documents in this digital era.

RSVP today to secure your virtual seat at this exclusive webinar.

All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.