Click Here to View The Newsletter in a PDF Document

_________________________________________

F E A T U R E D A R T I C L E

Is there a bubble in the real estate market?

Key Takeaways

Rising home prices have many worried about a real estate bubble like 2007.

While rising home prices may look a lot like 2007 on the surface, the circumstances driving home prices higher today are different and don’t resemble a bubble many are worried about.

If you know anyone who is in the market for a home, then you have likely heard anecdotes on how they were outbid multiple times with offers higher than the asking price. Home prices across the nation have soared over the past year. This rapid increase has unsurprisingly raised concerns of another housing bubble. In 2007, a housing bubble propped up by low-quality mortgages burst and led to a financial crisis and a global recession. So, are we in for a repeat?

The circumstances driving prices higher today are different than 2007. A closer look may help understand the fundamentals of today’s real estate boom.

Low mortgage and high savings rates have improved home affordability: While this may be shocking, despite higher home prices, housing affordability has risen with record low mortgage rates. The trend in the 30-year mortgage rate is remarkable from a record high rate of 18.6% in 1981, to roughly 6.5% in 2007, to below 3% in 2021.1 Lower mortgage rates reduce the percent of one’s income being spent on a mortgage payment and can improve affordability.

In addition to low interest rates, consumers benefited from an increase in savings. Some U.S. consumers are flush with cash right now because they were unable to spend on typical purchases during the shutdown. In addition, Congress supplied the economy with trillions of dollars in fiscal support. While the pandemic did lead to financial devastation for many and fiscal support partially or fully replaced lost income, not everyone was impacted. Many consumers remained employed and collected additional financial support during a turbulent time for all. This historic environment contributed to an excess savings buffer of $2.5 trillion.2 Add to that the incredible rise in the stock market driving investment accounts higher, as well.

With historic low mortgage rates, higher savings and larger investment accounts, consumers have more to spend on mortgage payments. The chart above shows, despite a sharp increase in median home prices, mortgage payments as a percent of household income has become more affordable.3 This remains in sharp contrast to 2007.

Homebuyers are in better financial health: In 2007, stories of no-income, no-down payment, no-verification mortgages were common. Today, banks have adopted higher lending standards. A simple way to see this is in the percent of mortgages issued today to consumers with high credit scores (greater than 760). Unlike 2007, where people with low credit scores (below 660) were granted more new mortgages than people with high credit scores, today 73% of mortgages issued in the first quarter of 2021 went to consumers with high credit scores.4

Housing supply remains constrained: The inventory of homes for sale fell dramatically after 20075 and has not kept up with demand. A few of the most common reasons for low inventory are the lack of property developers, shortages in construction labor, increased cost for raw materials and increased regulations. High demand and low supply have driven prices even higher.

While rising home prices may look a lot like 2007 on the surface, the underlying fundamentals are different from back then. Despite this, many will still be frustrated as high home prices have priced out many buyers. Home prices have risen due to a confluence of record low mortgage rates, increased savings, improved affordability, and low housing inventory. Pair that with healthier lending standards and these fundamentals don’t resemble a bubble many are worried about.

1https://fred.stlouisfed.org/series/MORTGAGE30US

2https://www.blackrock.com/us/individual/literature/whitepaper/systematic-fixed-income-outlook-summer-2021.pdf

3https://www.forbes.com/sites/raulelizalde/2021/06/23/home-prices-are-soaring-but-also-most-affordable-in-generations/?sh=462e91866c39

4https://awealthofcommonsense.com/2021/07/the-biggest-differences-between-now-the-housing-bubble/

5https://fred.stlouisfed.org/series/HOUST1F

AssetMark, Inc. 1655 Grant Street, 10th Floor

Concord, CA 94520-2445

800-664-5345

IMPORTANT INFORMATION

This is for informational purposes only, is not a solicitation, and should not be considered investment, legal or tax advice. The information in this report has been drawn from sources believed to be reliable, but its accuracy is not guaranteed, and is subject to change. Investors seeking more information should contact their financial advisor. Financial advisors may seek more information by contacting AssetMark at 800-664-5345.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio. No investment strategy, such as asset allocation, can guarantee a profit or protect against loss. Actual client results will vary based on investment selection, timing, market conditions, and tax situation. It is not possible to invest directly in an index. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Index performance assumes the reinvestment of dividends.

Investments in equities, bonds, options, and other securities, whether held individually or through mutual funds and exchange traded funds, can decline significantly in response to adverse market conditions, company-specific events, changes in exchange rates, and domestic, international, economic, and political developments.

AssetMark, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. AssetMark and third-party service providers are separate and unaffiliated companies. Each party is responsible for their own content and services. ©2021 AssetMark, Inc. All rights reserved.102814 | C21-17951 | 08/2021 | EXP 08/31/2022

How is Delta Affecting Consumer Behavior?

How is the recent increase in COVID-19 cases in the United States linked to the spread of the Delta variant affecting the U.S. consumer’s behavior? We look at some consumer confidence focused high-frequency data for clues on how this uptick in COVID-19 cases appears to be moderating behavior rather than having the dramatic effects that lockdowns had on economic activity.

“The Delta variant has weakened consumer confidence which has, in turn, added extra caution to our outlook,” explained LPL Financial Chief Market Strategist Ryan Detrick. “But widespread lockdowns seem unlikely and we see inventory replenishment and pent-up consumer demand as key reasons to remain bullish on the US economic recovery.”

High-frequency data from the TSA shows that air traffic through U.S. airports recovered to about 80% of pre-pandemic 2019 levels, peaking around the end of July at just over 2 million passengers per day. Since then the number of passengers has dropped by about 14%, however the influence of the Delta variant looks tempered as around 11% of this decrease would have been expected in a pre-pandemic environment related to the end of summer and children going back to school.

Data on U.S restaurant diners from Opentable shows a similar recovery from the pandemic lows of -100% to eclipsing pre-pandemic levels at the end of June of this year. There has been a slight dip since that full recovery and reservations are now down 10% versus pre-pandemic levels. The national data masks wide discrepancies in the data between different states and cities such as Nevada and Las Vegas showing increases of 38%** vs 2019 bookings even as New York state has seen a 38% decline and San Francisco has fallen 56% for the same period.

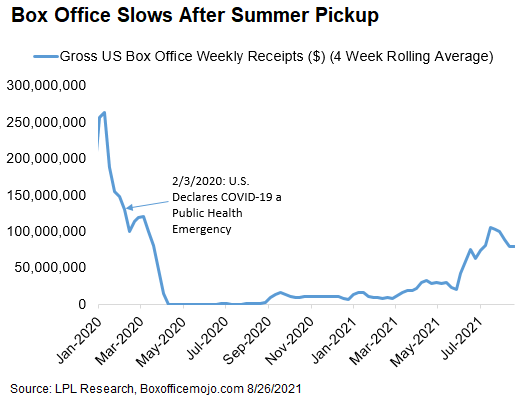

U.S theatre box office sales show the appetite to go to the movies has waned slightly during the past few weeks, from a peak in mid-July and it is still extremely depressed compared to pre-pandemic levels. Even at the recent peak ticket sales are less than half of the average weekly level for 2019.

There are a couple of unique factors that could be causing this data to recover more slowly than airline tickets and restaurant bookings. Demand for theatre tickets could have been permanently reduced by the substitute product of direct-to-consumer movie releases. There is also a supply issue, with studios not wanting to release their blockbuster movies in an environment where they could be playing to sparse crowds (due to any social distancing requirements or consumers choosing to moderate behavior and stay home).

As we continue to keep a close watch on how the Delta variant unfolds across the U.S, and its potential impacts on the economy and markets, we believe that there is a lack of appetite for renewed stringent lockdowns. More likely the Delta variant may have a smaller drag on the economy from the moderations in consumer behavior as shown in the high-frequency data. While other concerns like inflation and some recent data disappointments remain, we believe we’re still in the middle of a robust economic recovery with a solid outlook, which should provide a supportive backdrop for equities.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index and market data from FactSet and MarketWatch.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency

Not Bank/Credit Union Guaranteed

Not Bank/Credit Union Deposits or Obligations

May Lose Value

For Public Use – Tracking 1-05184876

SpaceX launches ants, avocados, robotic

arm to space station

A SpaceX shipment of ants, avocados, and a human-sized robotic arm rocketed toward the International Space Station on Sunday, August 29th.

The delivery — that arrived Monday, August 30th — is the company’s 23rd for NASA in just under a decade.

A recycled Falcon rocket blasted into the predawn sky from NASA’s Kennedy Space Center. After hoisting the Dragon capsule, the first-stage booster landed upright on SpaceX’s newest ocean platform, named “A Shortfall of Gravitas.” SpaceX founder Elon Musk continued his tradition of naming the booster-recovery vessels in tribute to the late science fiction writer Iain Banks and his Culture series.

The Dragon is carrying more than 4,800 pounds (2,170 kilograms) of supplies and experiments, and fresh food including avocados, lemons and even ice cream for the space station’s seven astronauts.

The Girl Scouts are sending up ants, brine shrimp and plants as test subjects, while University of Wisconsin-Madison scientists are flying up seeds from

mouse-ear cress, a small flowering weed used in genetic research. Samples of concrete, solar cells and other materials also will be subjected to weightlessness.

A Japanese start-up company’s experimental robotic arm, meanwhile, will attempt to screw items together in its orbital debut and perform other mundane chores normally done by astronauts. The first tests will be done inside the space station. Future models of Gitai Inc.’s robot will venture out into the vacuum of space to practice satellite and other repair jobs, said chief technology officer Toyotaka Kozuki.

As early as 2025, a squad of these arms could help build lunar bases and mine the moon for precious resources, he added.

SpaceX had to leave some experiments behind because of delays resulting from COVID-19.

It was the second launch attempt; Saturday’s try was foiled by stormy weather.

NASA turned to SpaceX and other U.S. companies to deliver cargo and crews to the space station, once the space shuttle program ended in 2011.

Title: SpaceX launches ants, avocados, robotic arm to space station

Source: https://nypost.com/2021/08/29/spacex-launches-ants-avocados-robotic-arm-to-international-space-station/

© 2021 NYP Holdings, Inc. All Rights Reserved

-Recipe of the Month-

Blue Cheese Stuffed Mushrooms

INGREDIENTS:

1 lb. medium fresh mushrooms

1/4 cup sliced green onions

1 Tbsp. butter or margarine

1 pkg. (4.5 oz.) ATHENOS Crumbled Blue Cheese

3 oz. PHILADELPHIA Cream Cheese, softened (can use microwave to soften)

SERVINGS: 8

TIME: 33 Minutes

INSTRUCTIONS:

Preheat broiler. Remove stems from mushrooms; chop stems. Cook and stir stems and onions in butter in small skillet on medium heat until tender.

Add blue cheese and cream cheese; mix well. Spoon evenly into mushroom caps; place on rack of broiler pan. (For more tender mushrooms, bake or sauté the mushroom caps for 5-6 minutes before you stuff and bake them.)

Broil 2 to 3 min. or until golden brown. Serve warm.

Sources: https://www.myfoodandfamily.com/recipe/051320/blue-cheese-stuffed-mushrooms; Produceforkids.com